According to a new Avalere analysis of data from the Centers for Medicare & Medicaid Services (CMS), premiums for stand-alone prescription drug plans (PDPs) will increase and the number of PDPs available in 2017 will decrease. Conversely, the Medicare Advantage (MA) market appears strong as nearly eight in 10 beneficiaries have access to MA plans that offer prescription drug benefits.

Key Takeaways

Part D

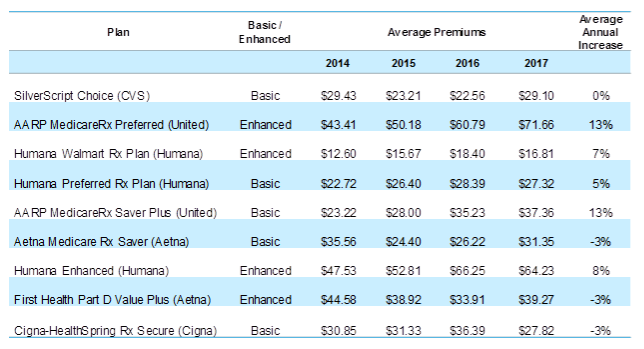

- Among the top 10 most popular Part D plans, some sponsors are raising premiums more than others. United is increasing premiums in the second most popular plan, AARP MedicareRx Preferred, by about $10.

- Overall, the number of PDPs has continued to decline. In 2017, 678 PDPs will be offered, down from 886 in 2016, showing a 23 percent decrease.

- Top 10 most popular Part D plans now represent more than 88 percent of PDP enrollment. These plans will have an average premium increase of 4 percent in 2017.

- There is a sharp decline in the number of $0 low-income subsidy premium plans. All 50 states show a decrease in the number of these plans.

“Medicare beneficiaries in Part D plans with premiums that are increasing need to be aware of what is happening with their plans” said Kelly Brantley, vice president at Avalere Health. “Beneficiaries who choose not to change plans could see higher premiums in 2017.”

Medicare Advantage

- 78 percent of MA beneficiaries will have a $0 premium option, compared to 81 percent in 2016.

- The average MA premium will drop 4 percent in 2017, to $31.40.

“These numbers suggest that Medicare Advantage enrollees continue to have strong access to plans with zero premiums, in spite of the changes that CMS made to the risk adjustment model,” said Caroline Pearson, vice president at Avalere Health. “We anticipate enrollment in Medicare Advantage will continue to grow in 2017.”

Figure 1. 2014 to 2017 Premium Increases by PDP

Methodology

On September 22, the Centers for Medicare & Medicaid Services (CMS) released the 2017 Medicare Advantage (MA) and Medicare Part D landscape files. Avalere analyzed the data to assess trends in plan participation, beneficiary premiums, and benefit designs for the 2017 MA and Part D markets. Avalere analyzes information for unique plan options offered within each market. Avalere excludes information on Cost plans, Medicare-Medicaid plans, and plans offered in the U.S. territories from its analysis. CMS does not include information on employer-group waiver plans, Program of All-Inclusive Care for the Elderly (PACE) plans, or Part B-only plans in the landscape files.

###

Avalere staff continue to be available to offer key insights on MA and Part D changes. If you would like to talk to an expert at Avalere, please contact Frank Walsh at [email protected] or 202-868-4820.

Avalere Health, an Inovalon Company, is a strategic advisory company whose core purpose is to create innovative solutions to complex healthcare problems. Based in Washington, D.C., the firm delivers actionable insights, business intelligence tools and custom analytics for leaders in healthcare business and policy. Avalere's experts span 230 staff drawn from Fortune 500 healthcare companies, the federal government (e.g., CMS, OMB, CBO and the Congress), top consultancies and nonprofits. The firm offers deep substance on the full range of healthcare business issues affecting the Fortune 500 healthcare companies. Avalere’s focus on strategy is supported by a rigorous, in-house analytic research group that uses public and private data to generate quantitative insight. Through events, publications and interactive programs, Avalere insights are accessible to a broad range of customers. For more information, visit avalere.com, or follow us on Twitter @avalerehealth.